If you are looking for a way to grow your insurance agency without the risk of hiring new employees, then look no further. An insurance virtual assistant can help you delegate tasks that would normally take up too much time and cost money if done by an employee.

In this guide, we will discuss how to hire a virtual assistant, what they can do for your insurance agency, and why it is so beneficial to use them in business.

What is an insurance virtual assistant?

An insurance virtual assistant is a remote member of your agency workforce. They are not official “employees” of your agency, they are either individual contractors or employees of another company that leases those employees to your agency.

An insurance virtual assistant often times lives overseas in another country. The Philipines and India are where most insurance virtual assistants come from. The reason is these countries are major hubs for large company call centers. Business outsourcing is a major part of these country’s economies. There is a lot of experienced workforce “talent” for virtual assistant companies to recruit from.

How much does an insurance virtual assistant cost?

The cost to hire an insurance virtual assistant varies and depends on the responsibilities you give them. For example, the average monthly cost of an entry-level insurance virtual assistant from a reputable insurance VA firm will range between $1700 – $2000 a month for full-time work.

The average monthly cost of a virtual assistant who has an insurance license and resides in the United States or Puerto Rico will cost between $4,000 – $4,500.

When figuring out your VA budget, it’s important to determine if you need a licensed insurance VA or if you only need a VA for clerical data entry and back-office tasks. Many agents might assume they need a licensed virtual assistant, when in reality, they are better off using a clerical VA to assist their existing team.

Where your VA lives will also play a major role in how much you should budget. The cost of living and expenses in India are different than in Costa Rica (if you need a Spanish-speaking VA) You’ll pay a slightly higher cost to have your virtual assistant speak to clients, perform bi-lingual tasks, or be skilled in the various technology platforms.

Typically an insurance VA firm will require an agent to sign a contract that says you must keep your VA for a certain duration of time. Thirty or ninety-day contracts are common, especially when just starting out with a new virtual assistant. These contracts are how virtual assistant companies protect themselves as they spend most of their time on the front-end training your insurance virtual assistant.

It is also a common practice for an insurance VA company to require a 30-day notice in the event you wish to cancel the VA service.

It is possible to source your own insurance VA for less money. However, the burden of recruiting and training that VA is yours. You would also need to be compliant with your E&O company regarding data security.

Many insurance VA companies are creating more pricing tiers to better serve agencies. These tiers are creating more flexible pricing options for insurance agents. An insurance agent should determine what the total scope of work is, the responsibilities that will be given, and the skills they expect their virtual assistant to have prior to hiring any insurance virtual assistant for their agency.

Many agents might assume they need a licensed virtual assistant, when in reality, they are better off using a clerical VA to assist their existing team.

The benefits of using an insurance virtual assistant

I have personally used insurance VAs for the last five years. I can speak about my own experiences of how insurance virtual assistants have helped me mitigate employee costs and payroll taxes while completing the tedious manual tasks of running an agency.

I interviewed two leaders in the insurance virtual assistant industry, Wess Anderson with AgencyVA and Andy Priesman from Cover Desk and asked them what they see as the major benefits of using a virtual assistant in an insurance agency.

According to Wess, a major benefit to hiring a VA is to fix a common problem that plagues many agency owners, finding competent staff. “There is a labor shortage in the insurance industry. Young people aren’t graduating from school and flooding our offices looking for work. Hiring a virtual assistant allows agency owners to delegate time-consuming tasks and focus on the important aspects of their agency.”

Andy echoed these same sentiments when he said, “licensed agents should focus on licensed agent work. The non-licensed work (data entry, phone reception) should be handled by a non-licensed virtual assistant.”

A common trend happening within many insurance VA companies now is their on-going training programs that train their virtual assistants on the same technology platforms used by insurance agents. Imagine being able to hire new agency workers who come pre-trained on your agency management system, or CRM and are just as good, if not better on those systems than you are. The benefit it provides to not have to worry about recruiting labor and training them on your systems is a major benefit that hasn’t been accessible to agents in the past.

10 tasks an insurance virtual assistant should do?

I’ll provide greater detail on each task below. Here are the top tasks from “simplest” to “hardest” an insurance virtual assistant should do in your agency.

- Data entry/migration/reconciliation into your AMS/CRM

- Underwriter warm-transfer

- Pipeline management

- Endorsement processing

- Email inbox management

- New Business and Renewal quote preparation

- Payment processing

- Phone receptionist

- Telemarketing cold leads / appointment setting

- New business issuance

1) Data entry in your AMS/CRM

Perhaps the most common task an insurance virtual assistant is hired to do is data entry or data “clean-up” inside the AMS or CRM. Start by giving access to your VA with their own credentials. By giving them their own credentials, you will likely pay more for your AMS, however, you’ll be able to track their progress or find teachable moments where more training is needed.

Since many software programs do not provide direct integrations to other software providers, your VA fills the gap and provides “manual integration”.

A virtual assistant can move data back and forth between different software programs and eliminate your duplicate entry problems. Your virtual assistant can go through all of your contacts and make sure your data is clean and up to date. They can override premiums and commissions inside of your systems to make sure your reporting is correct.

You should provide your VA with login credentials to your carriers so that they can go into your carriers and verify account data, current premiums, and commission payouts. When they spot errors, they can correct them in your AMS.

If you’re relying on your AMS and IVANS to always have that data listed correctly in your AMS, you’ll be disappointed. It’s common that there are issues with the downloads keeping everything accurate inside of your AMS. This is where an insurance VA can provide data hygiene and ongoing maintenance.

2) Underwriter warm transfer

You and your team have better things to do than wait on hold waiting for an underwriter or carrier representative to come to the phone and help you. It’s been estimated that agents who do not utilize a virtual assistant spend one hour per day waiting on hold with carriers.

Your virtual assistant can make these calls for you, speak to the underwriter, then transfer them to you when they have them on the phone.

Make sure you provide a dedicated phone line to your virtual assistant. Not only will this provide the ability to make phone calls, but you’ll also be able to record them and listen to them if an underwriter says something specifically.

PERSONAL STORY TIME: One time I had one of my virtual assistants call a carrier to get an underwriter on the phone. I gave my VA just enough information to make the connection with the underwriter so that the underwriter could pull up our clients risk before being transferred to me.

The underwriter mush have been having a bad day. They told my VA that they weren’t going to help them and to learn better English before calling back again.

I wasn’t too happy with what happened. I treated my VAs just as good as any other staff member (perhaps better). I called back personally and asked for the underwriter and their manager.

As you could imagine, I wasn’t able to get either on the phone, so I sent an email to my marketing rep and the Vice President of Sales with a recording of the call attached.

I made it very clear that if they ever wanted to see another piece of business from my agency ever again, they would figure out a way to make things right, and I will not tolerate any intolerance or disrespect of my team.

The next day my VA had a personal apology from my marketing rep, the VP of Sales, and the underwriter.

Moral of the story: From time-to-time, you might have to get your hands dirty and go to bat for your team.

3) Pipeline management

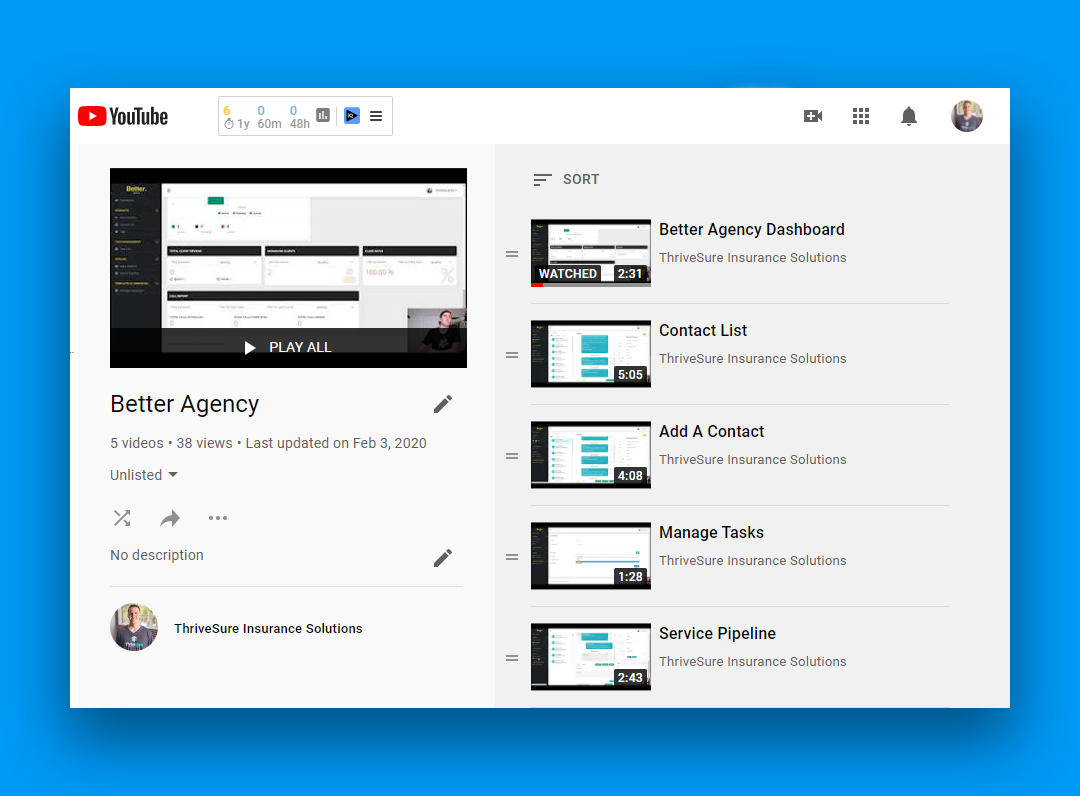

If you’re using a sales enablement tool with pipelines for sales, service, and renewals like Better Agency, you’ll benefit from having your insurance VA manage those drag-and-drop pipelines.

If your agency is a “high-volume” agency, your VA can act as “air traffic control” and make sure each contact is in the correct pipeline stage. A common problem agents have is getting behind in the CRM. If you will include your VA in important conversations with carriers and clients, they can make sure you stay on-top of your pipeline.

Another benefit of having your insurance VA work inside of your CRM, is you’re guaranteed to utilize more components of your CRM. The more features you task your VA to use in your CRM, the more benefit you’ll see from your software programs.

4) Endorsement processing

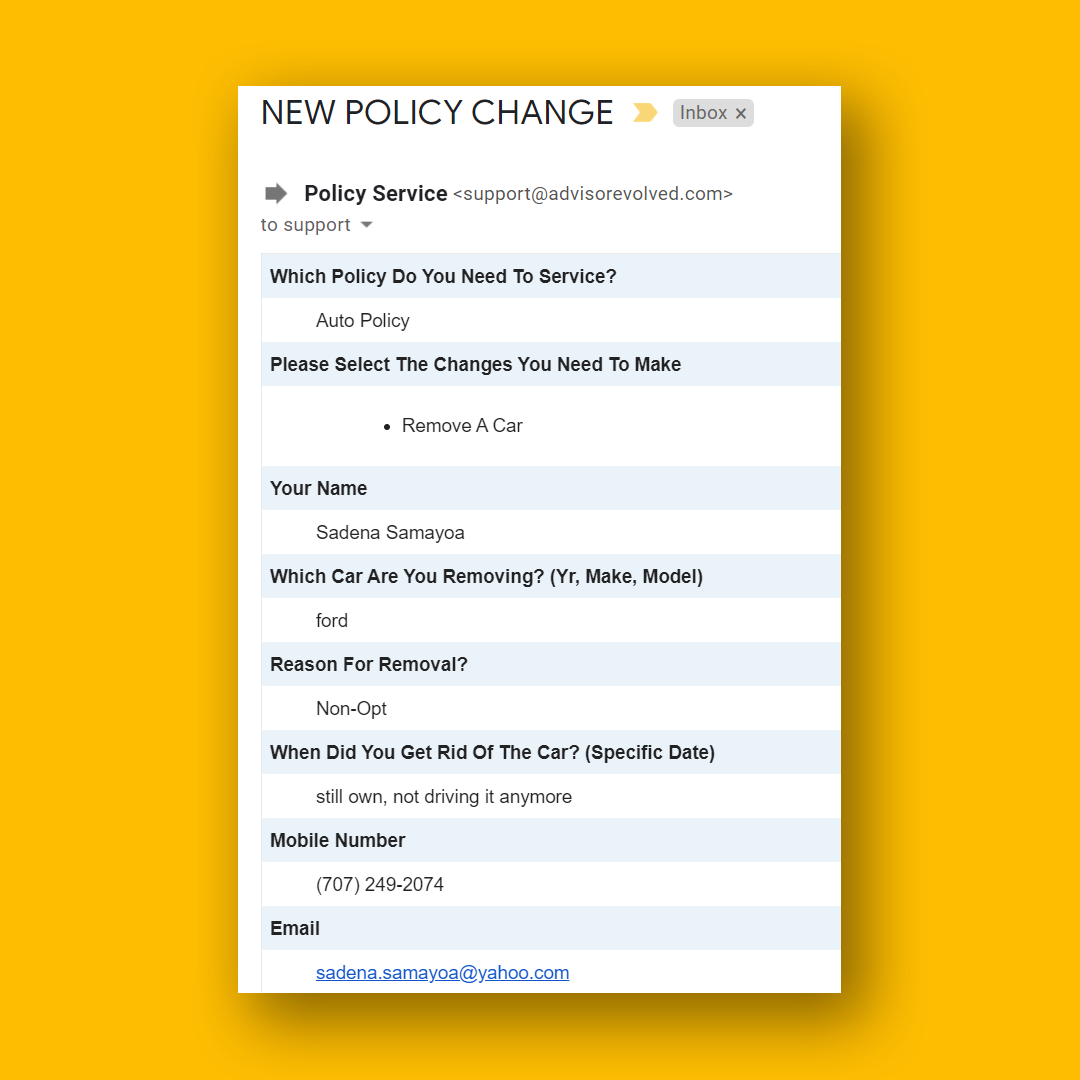

Your insurance virtual assistant should process all of your customer endorsements on your carrier websites. Make sure you are collecting all change requests in writing on your website using online form software like Gravity Forms.

Below is an example from Oakview Insurance Services in Yuba City CA.

Setup your website form to ask all of the required questions for each line of business. Once an insured completes the online form, it should email a copy to you and your VA. You can also setup a Zapier integration so that it notifies your agency inter-office communication tool like Slack.

Once the endorsement is completed your VA should notate the AMS with the proper notes, files received, and carrier confirmation. Your VA should include a screenshot of the written change request from the insured. Your virtual assistant should also set a task to complete a 7-10 day carrier follow-up to ensure everything was completed properly on the carrier’s end.

DISCLAIMER: Protect yourself by requiring all changes are requested in writing. (See website form example above)

As an agency owner, you are responsible for your E&O. Make sure to have quality control measures in place.

5) Email inbox management

This is self-explanatory. Your email inbox is flooded everyday from carriers, marketers, clients, and the occasional email from a certain Nigerian Prince who wants to offload his millions to you.

Your insurance VA can help keep your inbox clean and help you achieve and maintain the infamous “inbox zero”. You should have a process in place that allows your VA to segment your emails into the buckets that require your attention. Only you can determine what’s “important” and worthy of your reply or acknowledgement, and what should be deleted.

PRO-TIP: Another helpful task your insurance VA can do is “unsubscribe” from solicitor emails.

6) New business and renewal quote preparation

New business and renewal business quoting is a task easily handled by most insurance VAs. As mentioned before, many insurance virtual assistants come pre-trained on the industries existing comparative raters. Creating a process that allows your VA to handle data entry for inbound new business quotes will allow you to spend more time consulting with the client and less time being an “order taker”.

As is the case with handling endorsements, the more you can simplify the process, the better. An example would be to have prospects complete an online webform with the needed data for a quote. Another example would be to have your CSR or sales producer complete an internal form that asks for all of the needed information prior to quoting. This form can be given to your insurance VA, and they can complete the data entry.

Another use case is to have your VA complete all of the renewal quotes for your existing clients. These quotes can be kept on file internally. Some agents will set internal agency thresholds that provides a new quote to clients if they see a renewal increase over a certain percentage.

As always, the burden to make sure these quotes are correct lays with the licensed agent. Quality control measures should be put in place to safeguard the agency.

7) Payment processing

Once you feel a certain level of comfort and you have all of your needed security measures in place, your insurance virtual assistant can and should take payments over the phone. Later in this article, we’ll share some security protocols and resources you can use to make sure you are protected.

8) Phone receptionist

Make sure your insurance VA has a stable internet connection. If they do, you can add them to your VOIP (internet phone) and they can field inbound calls to your agency.

Many agents often wonder how their clients will feel about dealing with someone with an accent over the phone. According to both Wess Anderson from AgencyVA and Andy Priesman from Cover Desk, you should perhaps ease your VA into this role after they have been with your agency for a certain period of time.

If your VA has an accent that is hard to understand, you should hold off and give them resources that can help them improve their accent.

9) Telemarketing cold leads

What do you have to lose? Once you have your phone situation dialed in from step 8, you could turn your insurance VA into a telemarketer. It is my advice that you find an insurance VA who’s only responsibility is this task. It might be difficult for a VA to juggle multiple roles in service and sales. Also, a telemarketing VA will need to make hundreds of calls daily and will need the time allotted to do that.

As an agency owner, you should provide your VA with every resource they need to be successful. This includes data lists, scripts, bullet points, objection handling materials, role playing, etc. so that they can have more success.

Once you have a VA who is ready to tackle the phones, they should “dial for dollars” and be prepared to warm transfer leads who want to talk to an agent over to your sales team. Another friendly tip is to make sure your sales team is able to take outbound sales calls. What some agents do is block off time in the day where they can be in a rotation of other producers and take any transfer that comes in.

Of course, if you’re a single, owner operator, you’ll want to adjust and setup different times with your VA. If a VA cannot reach a salesperson, they should have access to the sales calendar and set appointments for call backs. When the time to perform a call back happens, the VA should make the second call and be prepared to transfer to a live agent.

Outbound telemarketing can work great for both personal and commercial lines accounts.

10) New policy issuance

This is only applicable if you have an insurance VA who is licensed in your state. Currently, the VA would have to be a resident of the United States or any of its territories.

The benefit here is an agency owner can control their costs. A flat fee to the insurance VA firm regardless of production from your VA will allow you to scale your sales team without having to worry about high commission splits with producers.

Your licensed insurance VA should have the same requirements, goals, and accountability metrics as any other in-house producer.

Meet Ailyn, one of my insurance virtual assistants

I interviewed Ailyn who has been an insurance virtual assistant for three years. She talked about the best and worst parts of her job. She handles quoting, payment processing, and endorsements and telemarketing.

She also explains what she needs from her agency owner boss in order to be successful.

Make your insurance virtual assistant part of the team

For the sake of this article, I’ve referenced “insurance virtual assistant” or “VA” a lot. But the number one way you’ll make them feel like they are part of your team, is when you no-longer separate your employees from your VA’s.

Your team is comprised of people, and these people have names, interests, hobbies, families. The more you treat them with that level of human respect, the more they will bend over backwards for you. They’ll start work early and end work late, and they likely wont even tell the VA company.

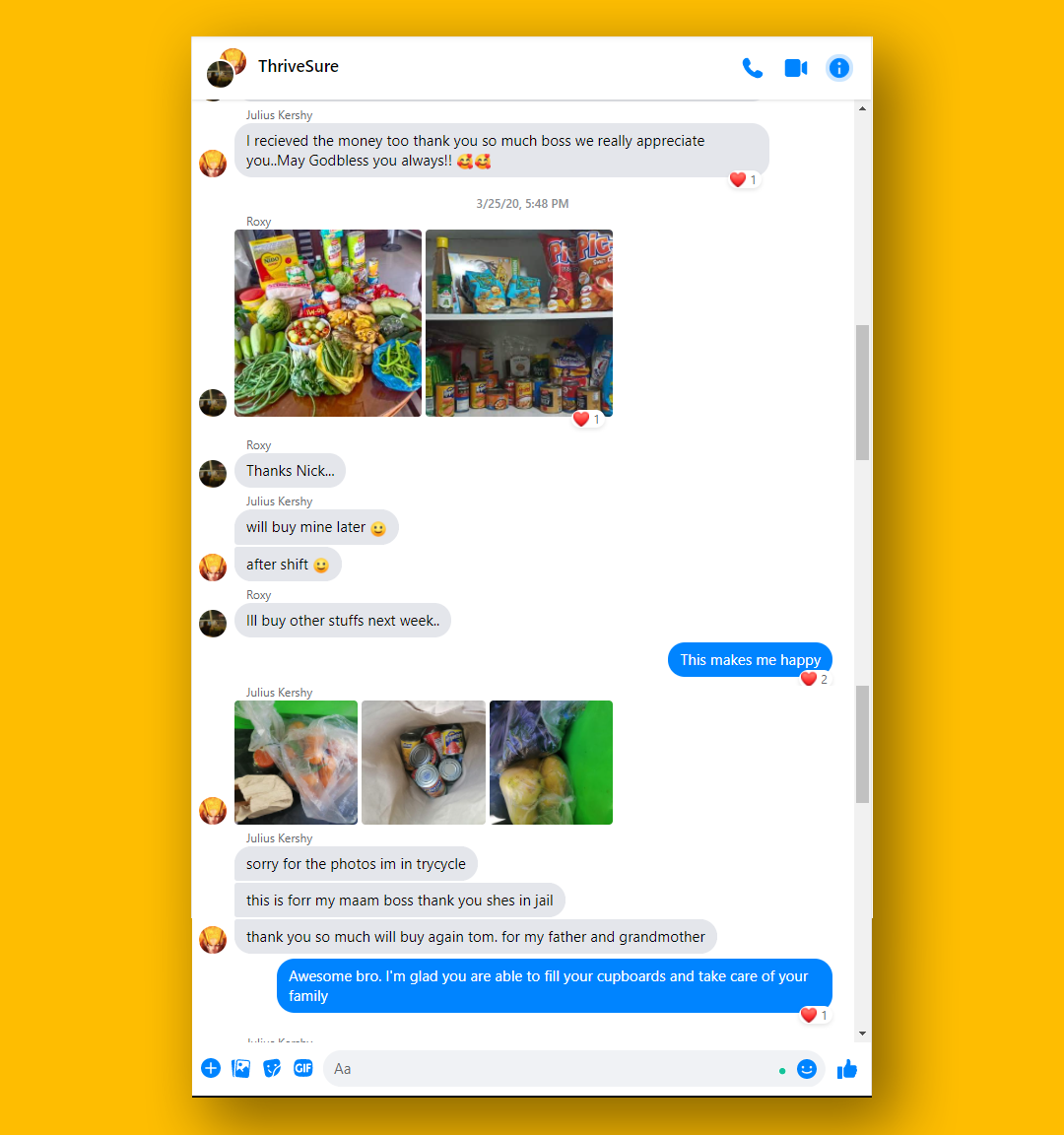

PERSONAL STORY TIME: In March of 2020 the Philippines was hit hard with COVID-19 restrictions and severe lock-downs. It was a real hard time for my team in that country.

I remember talking to my “lead VA” who informed me that another one of the VA’s was concerned with having enough money to buy enough food and medicine for their entire family living with them.

I did what anyone, including you the reader would have done. I wired $1000 to each one of my VA’s. That sort of money goes a long way in the Philippines.

My team was shocked. To them, $1000 was a lot of money. It allowed them each to stock up on supplies as they were headed for extreme lock-downs.

Moral of the story: Take care of your VA and they will always take care of you

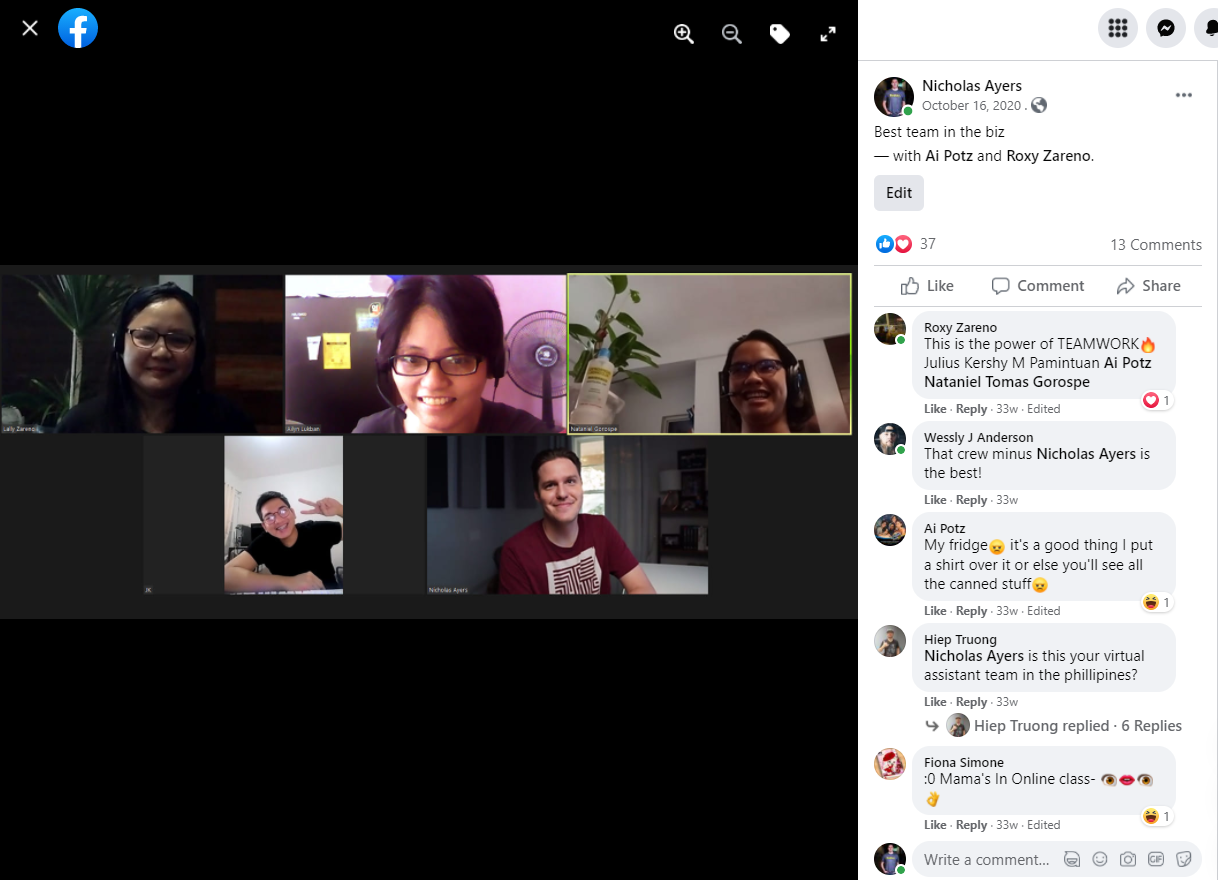

Your VA should have all of the tools they need in order to do their job. Use ZOOM video to include your VA in any important meetings. The more you make your VA feel involved in your agency, the better they will perform for you.

It is my encouragement that you hold one-on-one meetings with each VA either weekly or monthly and use the time to reflect on their performance. A favorite exercise of mine is to conduct rounds of “start, stop, continue” with my VA. This is where we take a look at their responsibilities and decide, “what should we stop, start, or continue?” Your VA will let you know that they are ready for more tasks. You should be prepared to give them more if they are ready to handle it.

Just as you would with any other hire, find creative ways to signal them out and give them public praise. This can be done in a company Slack channel, or on your social media feeds where you “tag” them.

PRO-TIP If insurance VAs are going to be a long term strategy for your agency, one thing you’ll want to hone in on is a “lead VA”. Find one VA that you can groom as a “lead VA”. This will have a big payoff down the road as you hire more VA’s. This lead VA will be able to manage the others. My lead VA’s name was Lally. Lally was with me for almost four years. She kept the other VA’s in-line, she held them accountable, and trained them when they needed assistance. I could always count on Lally. Sometimes, it felt like I was working in her agency.

Your VA team is comprised of people, and these people have names, interests, hobbies, families. The more you treat them with that level of human respect, the more they will bend over backwards for you.

Invest in your VA’s growth. A problem I see too many agents deal with is expecting every VA to come out of the box “ready”. Your VA will likely have some skills, but as Andy Priesman told me, “2-4 weeks isn’t enough to get anyone fully up to speed.” I’ll add onto his statement and say “2-4 years is hardly enough time.”

You should invest in their education and their skills. Treat your VA like a lifelong team member. A few things I did was I enrolled my VA’s into Total CSR, a training program for insurance agents and staff. I remember it costs a couple thousands of dollars to enroll them, but it was worth it. I required them to go through the course and complete all the tests. It wasn’t easy because they often did their training “off the clock”.

There are plenty of resources available for higher learning. You should invest in those platforms and enroll your VA so they can perform their job at a higher level.

Take advantage of every carrier training that is offered so that your VA’s can become masters at their craft and likely be in a position to teach you how to do things.

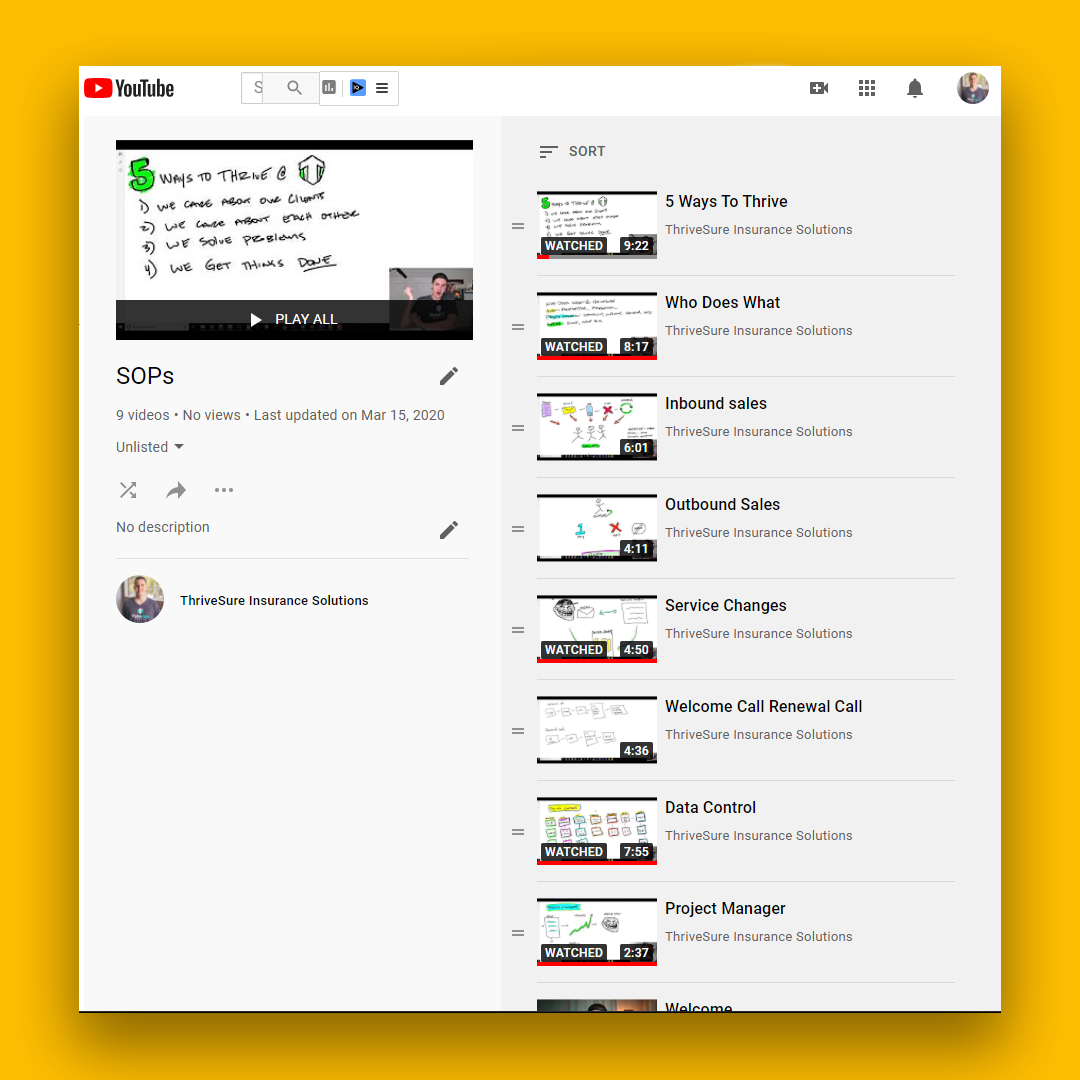

Create your agency SOPs and keep a video library of your trainings and tutorials.

A helpful practice for your new VA or any future insurance VA is to create a video library of your agency SOP’s (standard operating procedures) so that your VA knows who the company is and what is expected from them.

Make sure to record tutorials of any specific processes or software pieces that are unique to your workflow. Having this library accessible to them will help speed up their learning curve, and save them from asking you repetitive questions.

It creates a consistent experience for every new member of the team while saving you time in training.

Hiring virtual assistants yourself versus using a virtual assistant company – what’s better?

It’s not a good idea in my opinion to try and find your own insurance virtual assistant. You should use a dedicated insurance VA company to source and train your insurance VA.

The one positive thing about hiring a VA direct, is you can pay less money. On average, you’ll spend between $3-6 per hour for your direct VA. That is not a good wage, but it is a livable wage in the Philippines.

When you utilize a dedicated insurance VA company you have a line of protection and accountability. You will pay more, but if there is a data integrity issue, you’ll be able to hold the US-domiciled VA company partially responsible. With a direct VA, you have no recourse if there is a data integrity issue.

Insurance VA companies are specialists and can do the job of sourcing, managing and training far better than most insurance agents with no experience in the field.

If you’re dead-set on finding your own insurance VA, the best thing you should do is protect yourself, your agency, and your clients.

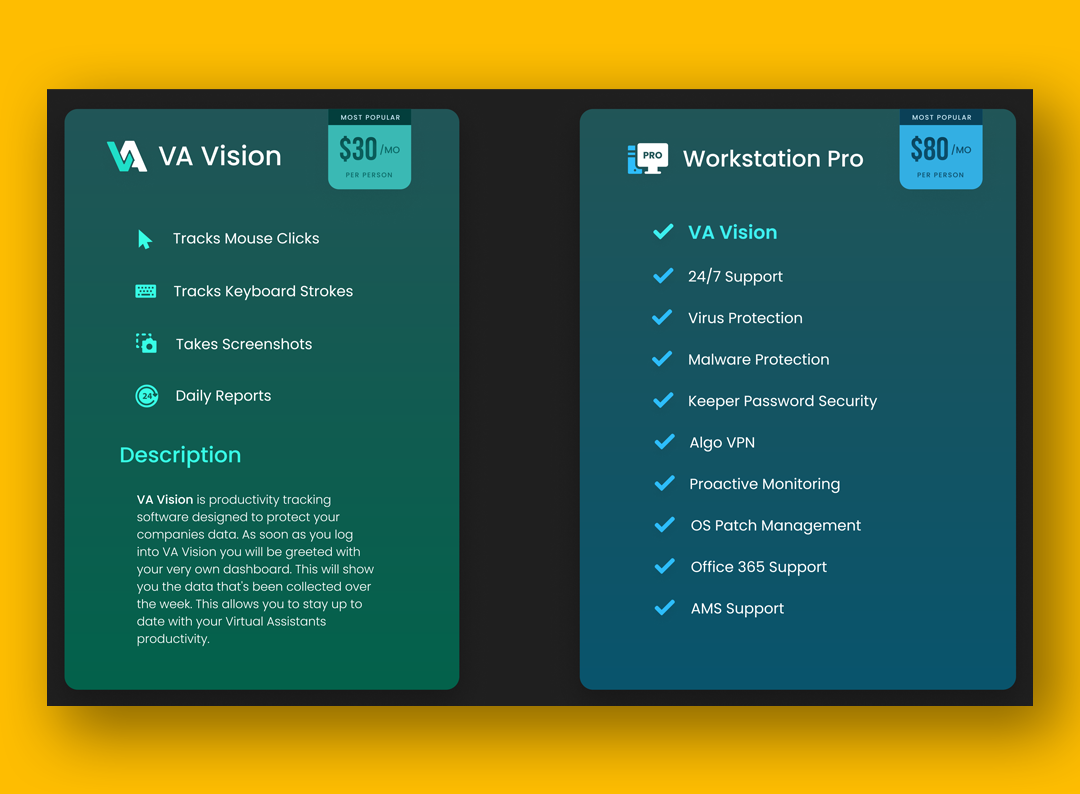

You can sign up and use the insurance carrier compliant software “VA VISION” from AgencyVA that tracks usage and offers support and protection. VA VISION is available as a standalone software product that anyone can use regardless if they aare an AgencyVA client or not.

In closing

Hiring an insurance VA is an amazing opportunity that agents have today. I have zero regrets with my decision to use a VA.

If you’re going to hire a VA, then make sure you have a plan. Don’t hire a VA because every other agent says you need to. Hire a VA because it’s the best thing for your agency.

Strategize and make a plan. You’ll likely need to tweak your plan, and that’s OK. It’s also likely you’ll need to replace a VA that isn’t the right fit for your agency, it happens.

Do your homework, you can’t go wrong with using a VA from either Cover Desk or AgencyVA. Both founders are insurance agents, they have a passion for our industry, and they will help you find the best insurance VA for your agency.