Why we’re so focused on customer lifecycle automation

Did you know that on average, a prospect needs to be followed up with 7-8 times before they make a purchase decision? Feels impossible doesn’t it?

When it comes to running their agencies, Independent Agents are often wearing too many hats and spinning too many plates. With their hands in sales, service, marketing, human resources, training, etc., it becomes difficult to see the “forest through the trees”.

As a result of working in every department, it’s inevitable that tasks fall through the cracks, the customer experience suffers, and business growth is flat.

As an Independent Insurance Agent, your relationship with customers goes beyond just the conversation you have when they buy insurance from you. While sales automation helps get more deals closed, it neglects other workflows like service and claim handling.

A full toolkit for independent agents to keep up with their many customers is crucial in order to be able to close more policies, stay on-top of your task list, and maintain client retention rates at renewal time.

At Better Agency, we spend a lot of time with independent insurance agency owners who tell us they feel lost in their insurance business.

One minute, they are receiving endorsements, the next, they have to contact customers on why rates went up at renewal and then follow up with prospects about quotes. It’s always back and forth and exhausting for agents.

Worse yet is when there is an accident or claim; it’s hard to know where you should be spending your time: “should I talk to the customer? Should I handle claims?”. We wanted something that would take care of all these items so independent insurance agents could focus on what makes them money while still concentrating on the bigger picture in their agency.

When observing the insurance technology landscape, we noticed there weren’t any options that helped agents automate their workflows. There was no customer lifecycle automation.

Sure, there are systems that help with “sales automation”, but “sales” is only part of the job. Any independent agent will tell you they spend as much time with “service” as they do with sales. There needed to be a better solution that allowed allowed agents to reduce their bandwidth and focus on the important tasks of running an agency.

We built Better Agency because we knew the old way wasn’t working. Other CRMs only focus on sales, but they neglect the other parts of running an insurance agency like service, renewals and claims. With customer lifecycle automation in place, agents can spend their time working “on” the business, and not “in” the business.

They’ll also be able to spend more time with clients without having to worry about tedious tasks such as sending emails or chasing cold prospects. Agents will be free to work on retaining customers that would have otherwise been lost due to renewal cycles – saving them money long term by helping them retain profitable accounts.

How does customer lifecycle automation work?

To put it simply, Better Agency has built-in workflows and automation campaigns for each department of your agency.

The reporting dashboard gives agents a birds-eye view of their agency numbers. You can see production, tasks, and commission revenue.

The Sales Pipeline allows you to monitor prospects throughout the buying process. Each stage in the pipeline is backed by its own built-in automation campaigns. As an example, the “New Lead” pipeline stage has campaigns with SMS/MMS texts, emails, and tasks that are automatically built-in.

Let’s say you generate a lead to your agency from a Facebook ad. The campaign will automatically know that this new prospect came from a Facebook ad and it will communicate with your prospect mentioning the ad they saw.

Multiple emails and SMS/MMS texts will then be sent to the prospect over the course of many weeks in an effort to engage the prospect and move them to the next stage.

Once you have made contact and quoted the prospect, the system will then perform multiple follow-up attempts to persuade the customer to buy the policy.

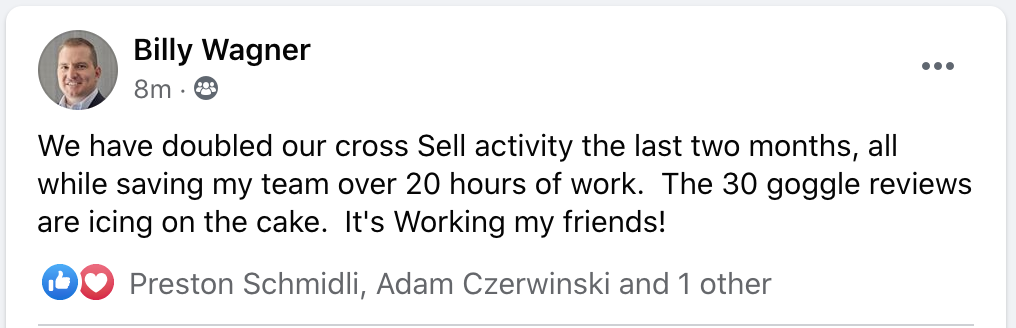

Once the policy is closed, Better Agency will automatically update your production numbers, and it will also follow up with the new client for referrals and Google reviews.

The Service Center Pipeline acts as an automated “ticketing” platform. Each service request can be automatically entered using various online forms, or manually entered from the client record. Once a service request is completed, it will notify the client, notate the client record, and ask the client for a Google review.

The Renewal Pipeline allows agents to communicate with every renewal automatically. Through our integration with IVANS, policy data is updated and agents can determine who they should spend their time with.

Better Agency allows users to set renewal increase thresholds that automatically communicate different messages based on their renewal increase.

Better Agency helps with customer lifecycle automation through seamless workflows that include integrations across multiple departments within an agency from renewals all the way into claims management by auto-communication gateways and prompts on every interaction.

The benefits of customer lifecycle automation

Customer Lifecycle Automation is the key to scaling your Independent Insurance Agency. It will allow agents to be more productive by eliminating the redundant tasks in their agencies. It will also reduce the number of mistakes made by agents.

Customer lifecycle automation is a top priority for any Independent Insurance Agent that wants to scale while maintaining profitability and increasing customer satisfaction. It provides an intelligent system that can be customized to your agency’s needs, creates a more productive environment for all departments within the agency, and increases agent output without sacrificing service or quality.

We know that one of the biggest struggles agency owners have is recruiting and training new staff members. With an optimized team and workflow, you’re less likely to need additional staff. Having more profitable margins allows owners to improve the “revenue per employee” metric and take better care of their current staff.

Customer lifecycle automation will help you save time by taking care of tasks automatically so that you don’t have to worry about them. It will be a huge time saver to have automated workflows that are customized for your agency. It’s also about reducing stress and having more free time so you can focus on what matters most- providing the best service possible

The benefits of customer lifecycle automation go beyond just increasing sales, it helps with: Decreasing expenses by streamlining repetitive tasks and creating more efficient processes.

How to get started with customer lifecycle automation

Better Agency is the first sales-driven AMS and data focused CRM. Better Agency is a customer lifecycle automation platform that supports the whole customer experience. It has tools and services to help independent agents better close more leads and retain clients after renewal.

Getting started with Better Agency is easy. Start your 14-day trial and get instant access. Our Customer Support Team will reach out and personally walk you though setting everything up. They will even help you launch your first campaigns during your trial so that you can see immediate results.

You’ll be able to see the power of Better Agency and all that it can do in a short space of time. And, if you don’t love what we offer, just cancel your trial before 14 days are up. Best of all – with a trial, there is no risk in trying our CRM for yourself!