Looking for the best CRM for insurance agencies?

Finding the best CRM for Insurance agencies can be a daunting task. In this article, we’ll break down the key features insurance agents should look for when selecting an Insurance CRM in 2021 and beyond.

Technology is advancing faster than ever. The way insurance agents do business is evolving even faster. It’s critical to have the right systems and processes in place if you are going to maintain efficiency and growth in your agency.

We will examine the major pain points felt by insurance agents and forecast what we see as the biggest hurdles faced by growing agencies and how your Insurance CRM should help solve these problems.

Re-defining what a CRM is

Before we begin, it’s important to define what an Insurance CRM is and how it differs from general-use CRM systems.

A CRM (Customer Relationship Manager) is a software tool that allows users to manage all of their customer interactions. The main objective of any CRM is to enhance the relationship with your contacts so that you can make more sales.

As insurance agents, our workflows may vary, but the core principles remain the same. Enhance the customer experience from prospect to customer so that we can close more sales, retain more business, and receive more referrals.

5 things every insurance CRM should do

There are five main non-negotiable features your Insurance CRM should do for you.

They should be viewed as pillars of a proper Insurance CRM. While your Insurance CRM will have many other features, these five are our non-negotiables.

When evaluating different systems, make sure these four features are not only included but that they are prioritized and well thought out.

1) Pre-written, done-for-you, time-saving insurance automation campaigns

We talk to insurance agencies every day of the week, and one of the most common challenges they encounter is, a vast majority of them do not understand how to create their own automation campaigns.

They don’t understand what to write, and/or how to make it sound convincing. After all, what you say and write in your campaigns makes a tangible difference in things like response rate, conversion rate, and general communication quality.

The best CRM for Insurance agencies should have these done-for-you campaigns included, which will save agencies literally hours and hours of time and headaches of trying to piece together campaigns themselves.

If you’ve ever said to yourself “I’m an insurance agent, not an automation specialist”, your CRM should pick up the slack for you and make it easier for you to deploy the various campaigns/automations you need to be successful.

Every basic CRM on the market will allow you to store contacts and offer some level of reporting such as “closed sales”.

The best CRM for Insurance agencies should do all of the basic tasks any traditional CRM would do. It should also provide more insights relevant to the insurance buying process.

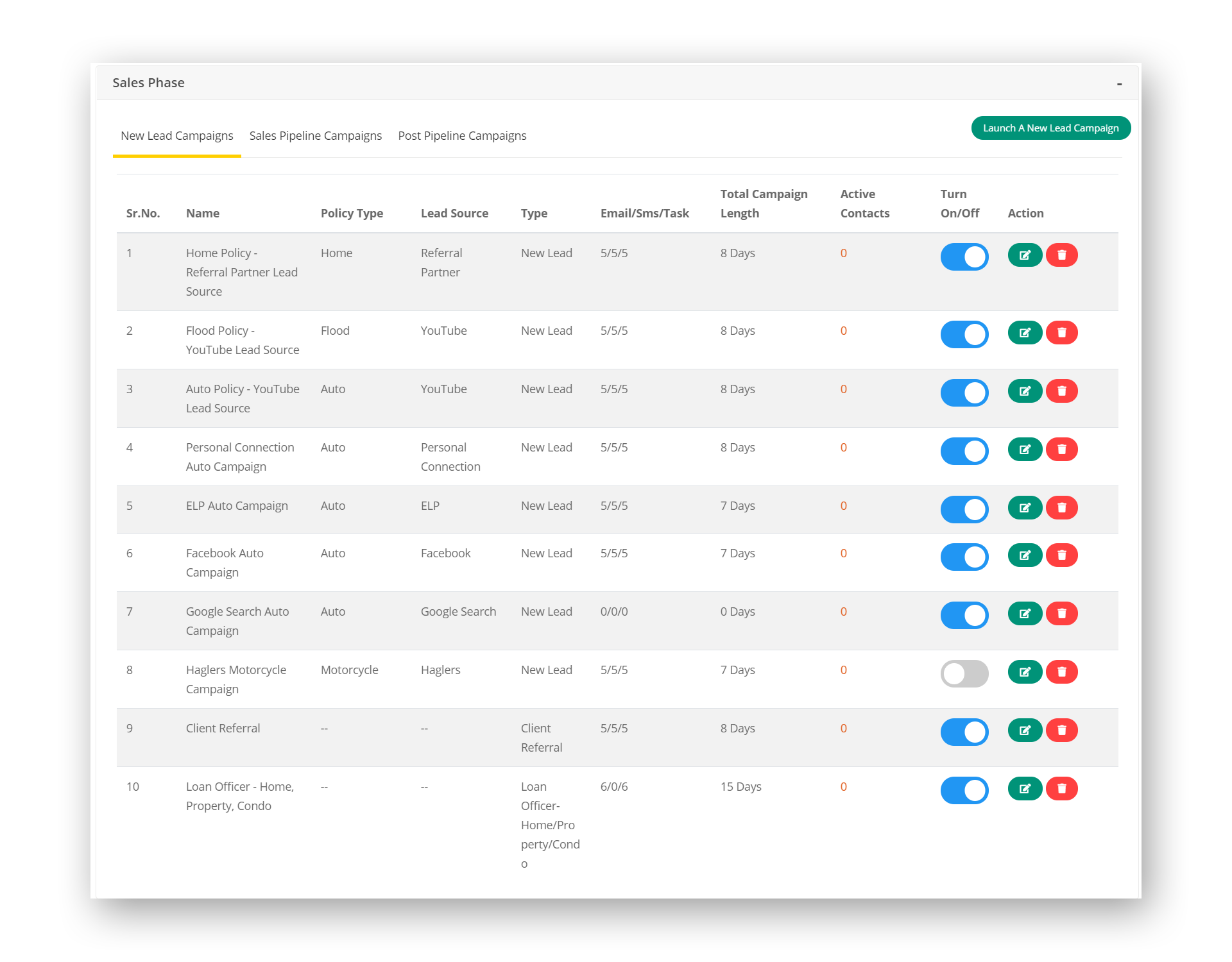

A true Insurance CRM will also provide sales automation to help insurance agents grow their agencies. This includes multiple insurance automation campaigns designed to help agents sell more policies.

It should include automation campaigns for cross-selling, prospect nurturing, X-dates, claims, renewals, and service.

The best CRM for Insurance agencies should provide these templates and campaigns for its users. If your software provider does not include these in the software, it’s likely they are not an Insurance CRM.

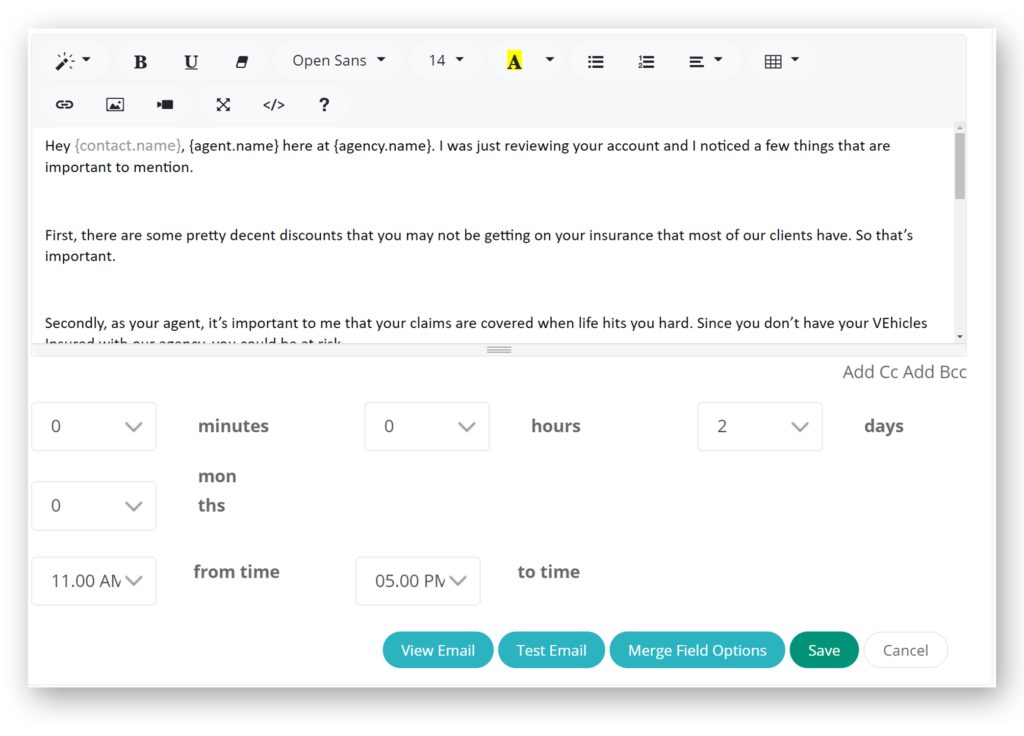

These insurance automation campaigns should be editable and you should be allowed to make them “sound unique” to your agency if needed. However, they should come included with your membership to that CRM.

There should be campaigns that help insurance agents regardless if they sell personal lines insurance, or commercial lines insurance. Having the ability to automate your communications and tasks is perhaps the most important aspect of having a true Insurance CRM.

While your Insurance CRM should have these campaigns already included, you should also be able to create your own campaigns from scratch if needed. It should be as simple as clicking a few buttons and writing out your words to create new personal or commercial lines automation campaigns.

You should have the ability to change any of the triggers or timings of your campaigns. As an example, if you’d prefer to start your campaign two days after the contact enters your system you should be able to change it.

Likewise, if you’d prefer it happened two minutes after they enter the system, that should be possible.

2) Built-in texting and two-way SMS

These insurance automation campaigns should always include SMS texting. It’s a given that email automation is included and your contacts are getting your emails, however, your Insurance CRM should have built in SMS texting included as well. This is no longer negotiable in 2021, you must use text messaging with your contacts.

If your system requires you to connect another texting platform to their system in order to work, then it’s likely that they are not a true Insurance CRM. Your Insurance CRM should simplify the process for you.

You shouldn’t have to deal with any other 3rd party software when it comes to texting in 2021. Integrating SMS and MMS (multimedia texting) in your insurance automation campaigns should now be a basic feature for any Insurance CRM.

Studies show that Insurance agents who use texting in their sales automation will always outsell their competition who do not use text message marketing. It is not just important for sales, but it is also a necessary component of the entire customer journey.

Texting will help you communicate more with clients, which in turn will help you retain more clients at their renewal.

3) E&O protection

Every Insurance CRM should provide insurance agents with the ability to store communication history and documents. It’s an important feature that will help safeguard an agent from an E&O claim.

Every text and email should be logged automatically and easily referenced to avoid any “he said/she said” scenario that would put an agent in a tough spot.

Having the ability to store critical notes and documents is another feature your Insurance CRM should do. This will allow agents to quickly reference any signed waivers, applications, or policy forms previously signed or given to your clients.

To protect yourself against a potential E&O loss, your Insurance CRM should store these documents and they should be safe from any user deleting or altering them. They should have a date and timestamp to show when the conversations happened, and when the proper documentation was sent out and received.

4) Pipelines for sales, service, claims and retention

A true Insurance CRM will allow sales agents to see and manage their various pipelines. You should be able to quickly view and edit these pipelines to ensure your prospects and clients are receiving the correct communications from your insurance automation campaigns.

The system should also provide workflows and automation campaigns for any CSR or service employee in the agency. Similar to a sales pipeline, you will want to have your service staff on the same platform so that there is a frictionless process. This will allow any service CSR or agency admin to see where customers are in the service process.

Perhaps the most important aspect of our industry is the ability to earn residual income from renewals. Insurance agents are always looking for more ways to increase their retention percentage. While it may be debated how that percentage is calculated, one thing is certain, we want our clients to remain clients within our agency for many years.

If your Insurance CRM does not allow you to properly track, manage, and communicate with your renewing clients, it’s possible you do not have a true Insurance CRM.

It is not enough to view renewals, but you must be able to categorize your renewals by important metrics such as line of business, policy/account owner, and percentage of premium increase. This segmentation will allow you to provide the right type of automated communication to your clients.

As an example, if you have a client who has a 12% rate increase at renewal, it should be built into your Insurance CRM to automatically place them in a different campaign sequence vs the client who had a much smaller rate increase. This workflow should happen automatically and work behind the scenes without you having to manage it too much.

Lastly, an Insurance CRM should help agents manage their claims process. This is a key differentiator between traditional CRMs and an Insurance CRM. Insurance agents need a simple way to communicate with their clients when they have a claim. Automated claims campaigns and workflows are the evolution of insurance automation. It should be a focus of your Insurance CRM to prioritize this feature.

5) Offer multiple 3rd party integrations

Every insurance agent has a different workflow. You rely on various tools to accomplish the task at hand. From VOIP internet phones to inter-office communication tools, to landing pages and chatbots, your processes and strategies can be very diverse. It’s important that your Insurance CRM provide a simple way to integrate these tools of choice into its system.

If your Insurance CRM does not have an open API to connect with platforms like Zapier, then you are working with a limited system. In 2021, insurance agents need every competitive advantage they can get.

This means Insurance technology companies must provide an easy path to integrate with specialty tools to help them do their job better. Choose a CRM that allows you to become more aerodynamic in your workflows.

What’s the difference between an insurance CRM and my AMS?

You might be wondering why you would need an Insurance CRM if you already have an agency management system. (AMS) While there might be some redundancies, the core features of an AMS are completely different from a true Insurance CRM.

The key feature for an agency management system is its connection to IVANS for policy downloads. Having other components like access to ACCORD forms and accounting are also novel features, however, it is possible to access these outside of a management system.

During a recent poll, we asked agents this question “If your agency management system didn’t have downloads, how likely would you be to keep it?” Surprisingly, the results were nearly unanimous, agents would leave their AMS system if it did not provide downloads.

Agency management systems are used mainly as an electronic filing cabinet for agents. While some have tried to bring in more CRM capabilities, they have not fared well with the majority of agents.

Another important thing to think about is “who owns my data?” You might be under the assumption that you do, however, you might be surprised to learn that in most AMS contracts, it is the AMS parent company that owns the client data once you enter it into their system.

This means they can sell your client’s data without your knowledge. It can also mean that if you ever attempt to leave that AMS vendor, they can charge you a substantial amount of money to release the data back to you.

This is a major difference between AMS companies and an Insurance CRM like Better Agency. With Better Agency, you control and own your client data. It is never sold or distributed to any vendor.

Your Insurance CRM will offer many more features to help with the entire customer journey. It should help nurture and close more prospects with insurance automation that texts, emails, and provide task management for each user.

Your CRM should also help sell more policies per household with cross-selling campaigns and also prompt each interaction to provide agency reviews on platforms like Google.

An Insurance CRM should help drive sales activities in your agency. It is more than “agency management”. An Insurance CRM is how an agency plays “offense” with sales and customer service.

3 ways an insurance CRM will help your agency

1) You will make way more commission

Your Insurance CRM should provide you with a sales pipeline that is easy to navigate. This pipeline should allow you to easily track all prospects and see where they are at in the buying process.

Each pipeline should come stock with insurance automation campaigns that help you close more prospects. These insurance automation campaigns should be structured in a way that feels very natural to your prospects.

The entire mission of any CRM is that it should help build better relationships with your clients and prospects. Your Insurance CRM should accomplish the same goal. It should help you build stronger relationships and rapport with your prospects and clients.

2) Cross-sell your current clients

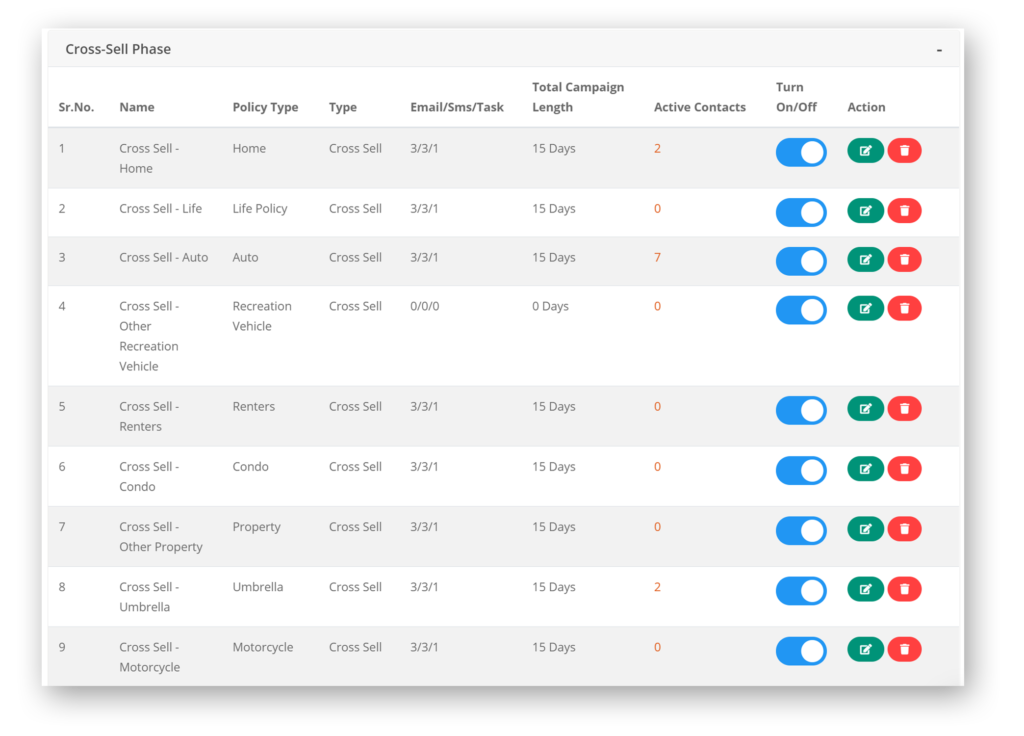

Perhaps one of the most important aspects of an Insurance CRM is the ability to cross-sell more lines of business to your clients automatically. This is a key differentiator between insurance agency management systems and even general-use CRMs.

Your Insurance CRM should provide “out of the box” insurance automation campaigns that allow you to easily cross-sell your entire book of business. Without this core feature, it would be difficult to define any system as an “Insurance CRM”. While cross-selling is not unique to the insurance industry, the way a client is cross-sold has many variables and nuances that make it different from other industries.

As an example, an insurance agent may need to wait to quote and cross-sell an umbrella policy until a driving record improves. Or if a client purchases a new home and now you want to offer a life insurance proposal. These client-specific details should trigger new insurance automation campaigns that help you sell more insurance to existing clients. Your Insurance CRM should also provide a way to upload client lists in bulk, add them to an insurance automation campaign and begin cross-selling them immediately.

3) An insurance CRM will increase retention

An Insurance CRM is a must for any insurance agency that wants to increase sales. It is also critical to helping you improve your agency retention.

Having the tools to communicate with current clients prior to their renewal will allow agents to retain more clients at renewal.

Today people are bombarded with advertisements from direct writers and your competition. It is imperative that you provide multiple touchpoints during their term and before renewal to prevent them from leaving. After all, any CRM should help you manage and enhance your client relationships.

Does your current system provide an easy way to communicate with your entire book of business prior to their policy renewal? Are you able to view all upcoming renewals and easily check on any notes for that client? Are you able to classify all renewals into different categories based on a chosen rate increase? If not, it’s likely you do not have an Insurance CRM.

If you are using your Insurance CRMs automated renewal campaigns, you will likely communicate with your clients before they ever receive their policy renewal in the mail. This proactive approach will allow you to create a potential cross-selling opportunity.

It will also allow you to evaluate your client’s current needs and provide alternative solutions. By implementing this strategy, you should see an increase in new business and agency retention.

Running an insurance agency without an insurance CRM will cost you money — period

And probably a lot of money at that.

When you have to manually track tasks and results it means you have less time to complete the tasks you need to in order to properly run your insurance agency. As a manager or owner, your time is too valuable. If you are not efficient, you can lose money.

Sales agents are talking to prospects and clients and too often, the important details find themselves written on a napkin or sticky note and not placed in the one area that will help them close more business.

Details are often lost, appointments are not kept, priorities are changed. As a result, you lead a “reactive” sales organization rather than a “proactive” sales team. You likely feel the stress of having to put out new fires as they arise and never breaking through the glass ceiling of your agency.

You are unable to scale the agency you want. It can all be compounded if a key sales producer leaves. But it’s not just sales that suffer without an Insurance CRM. Your agency clients will likely become more confused as they attempt to contact you in ways your agency is not equipped to handle.

Clients who wish to text vs email will likely leave to find a more conducive way of doing business. Without a single system for customer interactions, communications can be missed or lost, leading to a slow or undesirable customer experience.

However, with a single platform for all communication and engagement, you can properly stay on top of all client communication. Having a dedicated sales pipeline where you can track prospects and clients will allow you to focus on more revenue-generating tasks.

If you can use the insurance automation campaigns to communicate with clients and set tasks for your team you can become more efficient and convert your agency to a “proactive” sales organization.

How should an insurance CRM treat new users?

Now you’ve chosen an Insurance CRM, now what? Do they offer a trial period? How should onboarding work? Having the ability to test drive the system is important to make sure you are making the best decision possible for your agency.

Typical trial periods can last anywhere from seven to fourteen days and it is our opinion that you should be able to cancel at any time.

Choose a system that makes using the system easy. One that makes user onboarding a priority. While it might be simple to use a system, it’s our opinion that the CRM company should conduct new-user onboarding so that you can implement it quickly. The sooner you can use the system, the sooner you can see results and fall in love with the platform.

Personal onboarding is important. As is ongoing support. Because different systems have different cost commitments, make sure that the level of support is equal to that cost. Sometimes insurance agents can be fooled with low sticker prices, only to find out that support for the system is often minimal or non-existent.

Does the Insurance CRM provide fast support for their system? Can you chat with a live person? Do they offer a library of self-guided tutorials and support articles?

Any good Insurance CRM platform will offer a support team to help you fix any issues you might encounter. During “off hours”, there should be plenty of documented resources to help you solve any problem you face.

Another layer to support should include a user group on a platform like Facebook or Slack. Make sure to check before making a decision on an Insurance CRM.

Better Agency offers the whole package

If you are looking for a true Insurance CRM to handle the complexities of your agency, then we encourage you to try Better Agency.

Better Agency is the fastest growing Insurance CRM. It was created by insurance agents and allows you to grow your agency with built-in sales automation campaigns.

All of the campaigns are done for you and included in your Better Agency membership. Users can take advantage of our “done for you” email and text campaigns for personal and commercial lines insurance policies.

Better Agency helps the entire agency. Our sales, service, renewal, and claims pipelines allow every member of the team to work in harmony. You can access notes, attachments, and communicate with clients in one system.

Better Agency provides comprehensive agency reporting so that you can quickly assess the health of your agency.

Better Agency provides ongoing support and training so that users can stay on top of the many new features that get released. Our chat support, document library, and user Facebook group provide help to any question you may have when using the system.

Schedule a Discovery Call with Better Agency now.