You may have heard of Zapier from some of your colleagues, friends, or other insurance agents in the industry. It’s a powerful automation tool that helps people connect apps together without any coding knowledge. But what is it exactly?

How can you use it to take care of all those tasks that keep you busy? What are the steps to set up Zapier and get started automating? We’re going to answer these questions and much more with this guide for insurance agents looking to automate their agency workflows using Zapier!

What is Zapier?

Zapier is an “if this happens/then do this thing” program that connects over 3,000 different software applications together.

Think of your agency software as a person in an unknown land. This “person” doesn’t understand the language, customs, or culture of this new place or the “persons” there. Think of Zapier as a translator and guide. The translator understands the language of the “person”, and also the language of the other software.

Zapier allows the two software systems to communicate with each other through Zapier.

What Should I Automate in my insurance agency with Zapier?

- Online forms into your CRM.

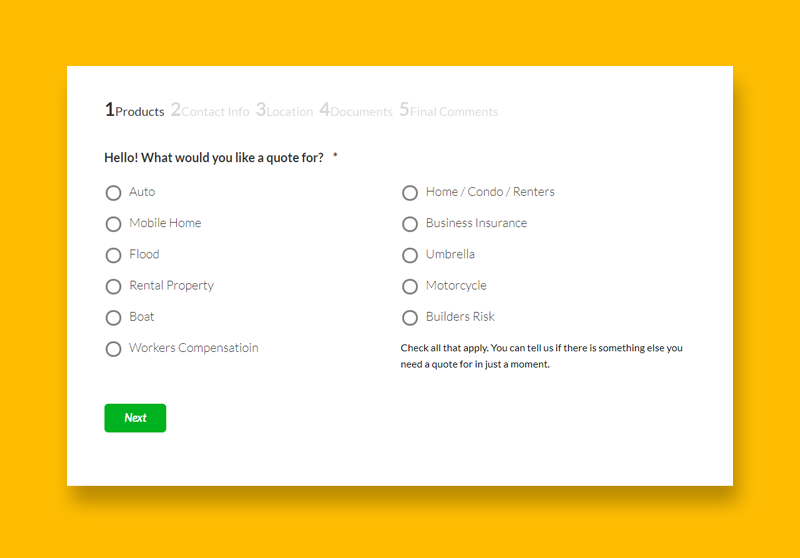

Example: Let’s say you have an online form to collect quotes on your agency website but doesn’t know what to do with entries from people when they are completed. You also may have a CRM (customer relationship management) software program like Better Agency that manages your customer data and contacts.

With Zapier acting as the middleman between these programs (being able to speak both languages), you can connect these two apps together so when someone fills out an online form from your website, it automatically (through Zapier) goes into your CRM.

Your website should have multiple forms for prospects and clients alike to submit information and make requests. These forms should be for quoting and service. There are multiple form vendors and each has a specific use case where they outperform other providers.

Some of our favorite form providers are:

Gravity Forms: Gravity Forms work great on WordPress websites. They can match the style of your existing agency website. We like Gravity Forms so much, we use them all over our own website.

TypeForm: Typeform is a great option for online “lead generation” where you just want to gather data. They also are great for customer surveys.

JotForm: JotForm is an economical option if you need something cheap and simple to use. It won’t have the quality design options you will find in Gravity Forms or TypeForms.

If your CRM has built-in sales and service automation campaigns, then you can set up a “Zap” in Zapier to automatically start the campaigns when a new form is submitted. This sort of automation can prevent duplicate entry and allows you to reach out to every contact when they are trying to connect with your agency.

- Notifications to your team

If you use any interoffice communication tool like Slack, you can notify people or channels when something happens. You can also use the information provided to auto-populate a Google Sheet or Excel spreadsheet.

Examples:

- A new lead fills out a quote form – notify the sales team.

- A missed call notification from your VOIP – notify the receptionist.

- When a document is eSigned – notify the service team.

- When a client or prospect completes a form – populate a spreadsheet.

There are countless other ways an insurance agent can use Zapier to automate processes and workflows. It mainly depends on the software you are using in your agency.

- Personal touch

It can be hard nailing down all of the touchpoints needed in order to make your contacts “feel the love”. If your agency has a large book of contacts, then it is virtually impossible to do it everything manually. Here are some ways to automate different touchpoints in your agency using your CRM.

“Handwritten” Postcards can be sent to prospects and clients for various reasons such as referrals given, renewals received, or just to say “we appreciate you”. You can use a vendor like Thanks.io in order to automate this process with any sort of list or tag in your agency CRM. The postcards can be customized to fit your agency brand, and they give off the appearance of being handwritten.

Ringless Voicemails. As is the case with postcards, you can use Zapier to automate ringless voicemails to your agency contacts. This can be useful for a broadcast campaign like a “referral program” or even notifying customers about certain weather conditions to avoid claim situations. On that note, if you need to contact a large group of clients affected by a claim, you can use ringless voicemails to deliver updates and information.

- Review Management

You can use Zapier to manage your online Google reviews and also re-purpose new reviews for marketing purposes. This is how it works. If you get a new Google review, you can use Zapier to publish that review to your agency’s social media accounts. It can include a picture of a happy person and your agency logo. This is useful to help spread social proof automatically for your audiences to see online.

Another example is to create an autoresponder that responds to each review as soon as it is submitted. In your auto-reply, you can use Zapier to include the reviewer’s name, so that it feels more personable.

5 steps to creating your first insurance “zap”

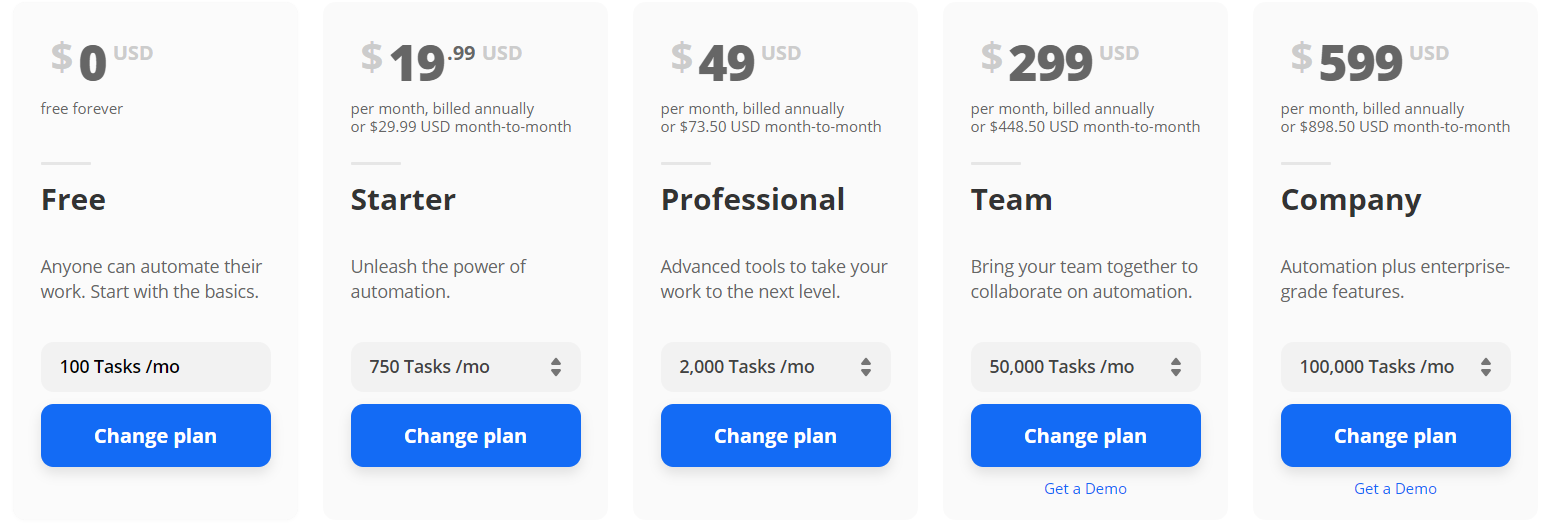

Step 1: If you have never used it before, then first create an account. You can make a free account or a paid one. The difference between the two is that if you make a free one, then notifications will come later than they would for the paid one.

If you are using Zapier to automate new lead follow-up, then it might be better to have a paid account so that when someone completes a quote form on your website they get their email almost instantly and not 15 minutes later. For new users, we suggest the “Professional” plan which is currently priced at $49 a month.

Step 2: Think about the processes you want to improve now with automation. This will require you to take inventory of your current agency tech-stack and determine which processes are currently eating away all of your time and resources.

There might be a level of added difficulty if your current agency management system does not have a Zapier integration, or if their current integration is very limited. If this is the case, you might want to consider moving to an agency management system that has a Zapier integration.

The reason for this is as software apps become more prevalent in running a modern-day agency, you’ll want to have more of those apps working in harmony with one another. If your agency management system fails to integrate with these systems directly, or with Zapier itself, it will likely result in a lot of manual data entry and duplicate work.

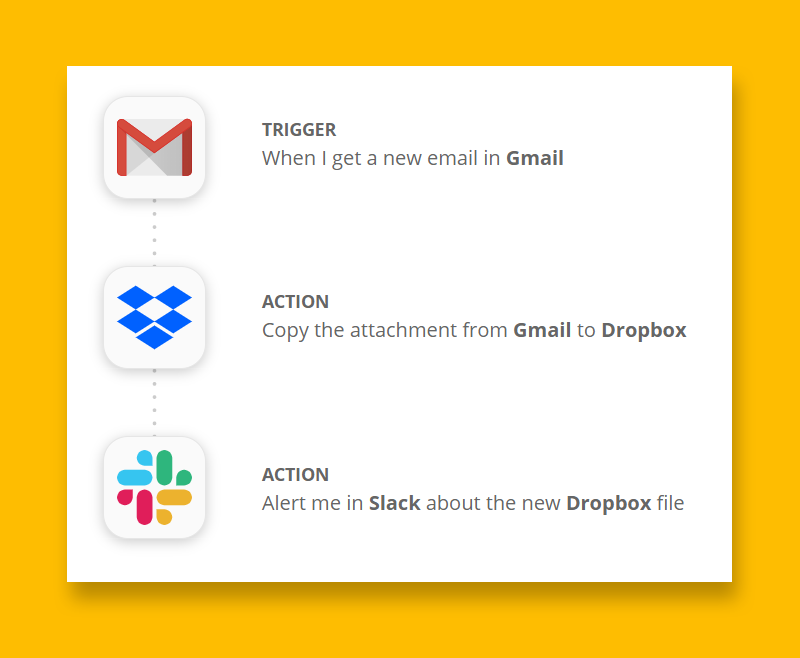

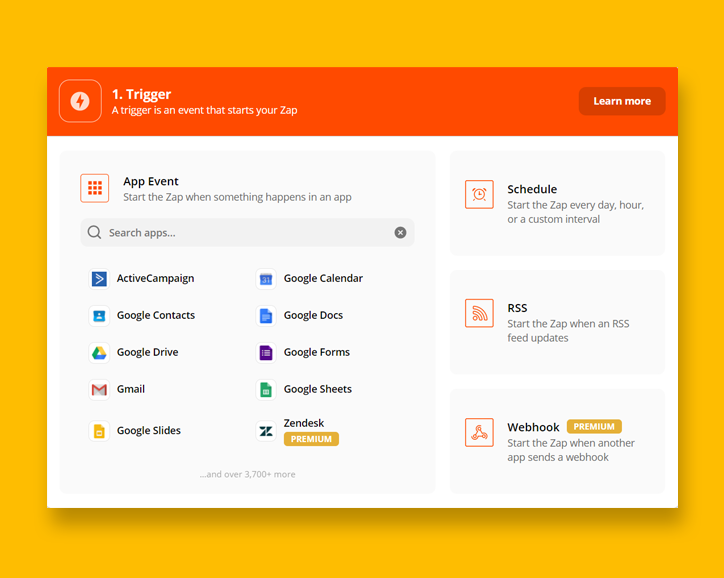

Step 3: Inside Zapier, you’ll want to create a “trigger”. A trigger is just like it sounds, something that triggers the next event. As an example, a trigger could be a form being completed. This trigger sets off the chain reaction. It is what needs to happen in order for the next action to take place.

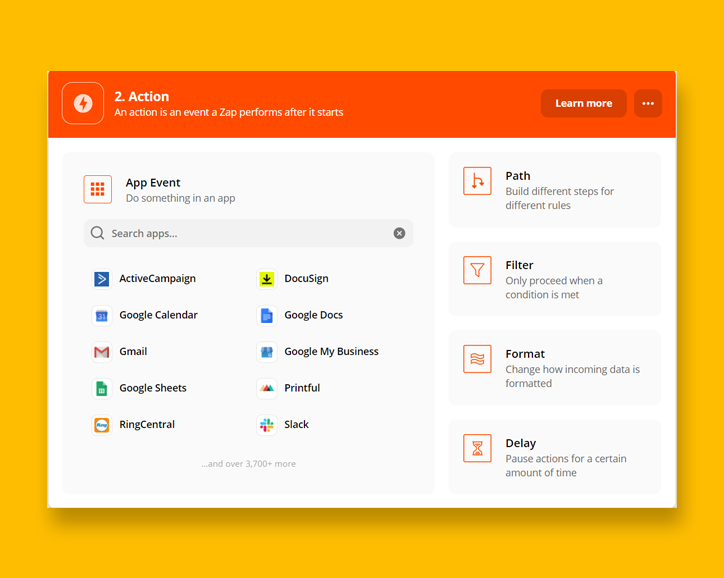

Step 4: Select the next action. This is where you select “what happens next” from your trigger. A popular “action” for your insurance agency could be updating a “prospect” in your CRM when they schedule an appointment on your calendar. Your prospect could move into a specific “deal stage” automatically and start a new series of automated email campaigns.

One important note before you start

Before you can set up your new zap, you’ll need to create a “sample submission” in your trigger app.

Simply put, if you’re wanting to move data from an online form into your CRM, you’ll need to go through your form and complete an entry. (it doesn’t have to be real information).

This is needed because when you set up your new zap, Zapier is going to look for an entry to “test” your new “zap” with.

How to set up your trigger in Zapier

Let’s build our first zap. For this demonstration, we’ll create a multistep Zapier automation from a single online new quote form submission from your agency website.

After you create a Zapier account, you’ll need to log into your dashboard. Locate the “Make A Zap” button. On the next screen, you will select your “trigger”. Remember, the trigger is the “when this happens” event. For our example, we will select our online web form company Gravity Forms. The trigger event is a “form submission”.

You will need to follow the steps to log into your Gravity Forms. This step will only need to be done once.

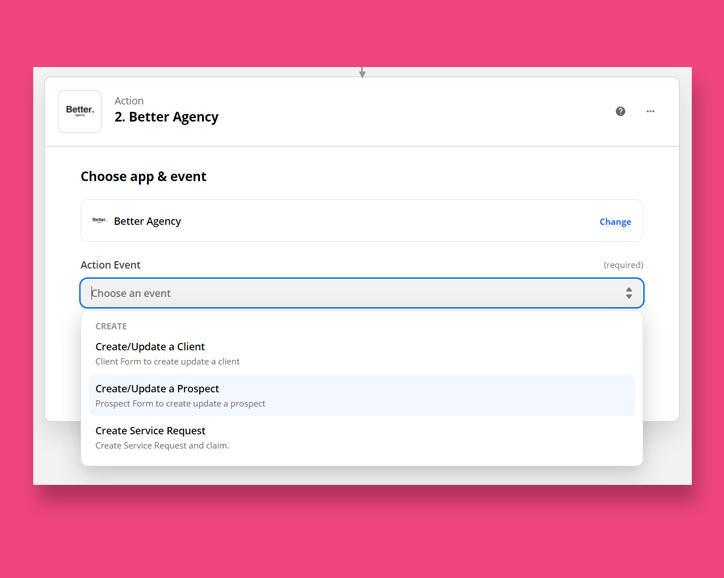

How to set up your actions in Zapier

Once you have set up your trigger, the next step is to make that trigger do something. In this example, the trigger wills end our new quote submission to our CRM where automation campaigns can start automatically.

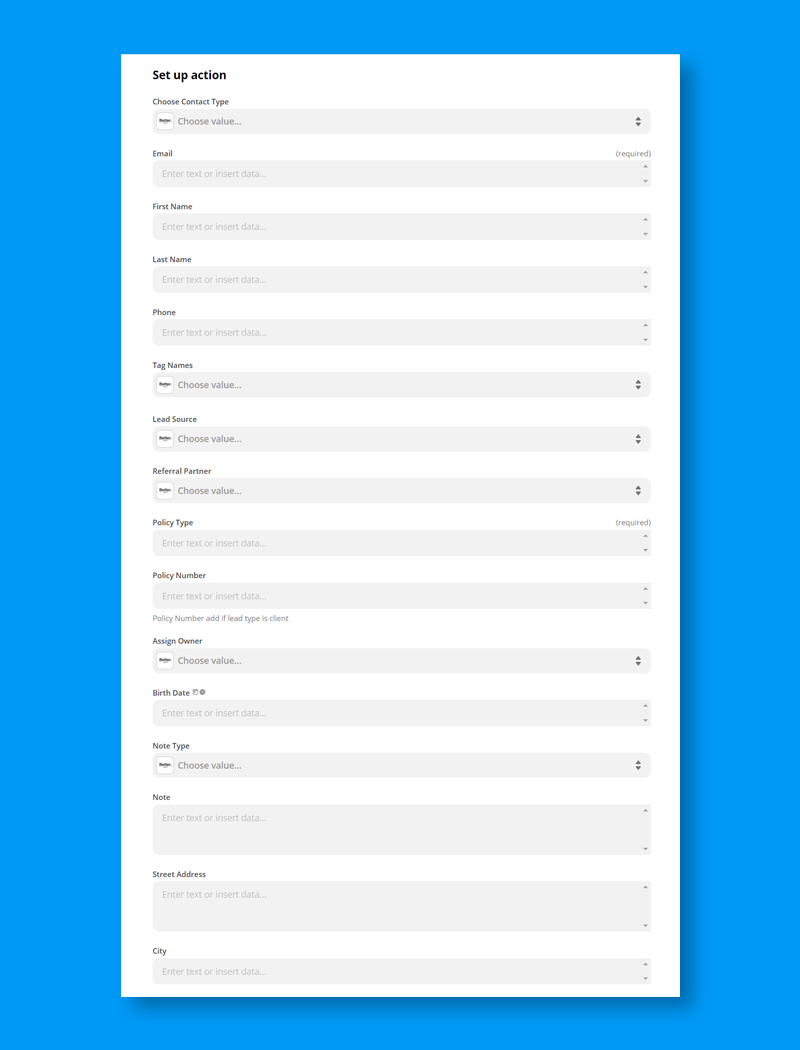

Select the correct “action event”. Since this is a new sales lead, we will select “create/update a prospect”. Next, you will map the data from your form to fields inside of your CRM. Once you map these fields, then every time this same form is completed, it will automatically move that data from the form to the same fields inside of your CRM. Once you’ve “tested” the action step, go into your CRM and verify it all worked.

You can keep adding more action steps by clicking on the small plus button underneath the “continue” button. For this example, we will also send the same data to our agency Slack channel for inter-office communication and notifications.

Follow the same steps from above and complete your action setup.

Better Agency works great with Zapier.

If you’re in the market for an insurance CRM/AMS that has a great Zapier integration, then look no further than Better Agency. Learn more about Better Agency by watching our demo video here.